pay utah state property taxes online

An electronic check payment or e-check has no fee. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext.

. The system provides the option of making payments directly from your credit debit card or e-check or by phone at 1-800-764-0844. Online payments may include a service fee. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335.

Follow the instructions at. Before continuing please make sure that. Payment Types Accepted Online.

How Do I Pay My Property Taxes In Utah. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. If a credit card is used as the method of payment the following.

Pay for your Utah County Real Property tax Personal Property tax online using this service. File electronically using Taxpayer. Tax rates may change quarterly.

You will need your. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment. Salt Lake County hopes that you find paying your property taxes online a quick and simple process.

They conduct audits of personal. Step 1 - Online Property Tax Payments. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

7703 The Utah State Tax Commission. What You Need To Pay Online. You may pay your tax online with your credit card or with an electronic check ACH debit.

File electronically using Taxpayer Access Point at. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. The Treasurers Office sends out the final tax bill receives property tax payments and distributes the funds to the various taxing entities.

Your Personal Property Account Number. Call 877 690-3729 code 5450 to pay your property taxes by telephone. Other Ways To Pay.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. Please call 801-451-3243 for assistance or for IVR telephone payments 877. Utah is ranked number thirty two out of the fifty states in order of the average amount of property taxes.

You may request a pay plan for business taxes. If paying after the listed due date additional amounts will be owed and billed. Pay for your Utah County Real Property tax Personal Property tax online using this service.

If paying after the listed due date additional amounts will be owed and billed. The County Commission approves the. Please note that our offices will be closed November 25.

In order to comply with the tax code the Washington County Treasurer uses a third party to process credit card payments for VISA DISCOVER and Master Card. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

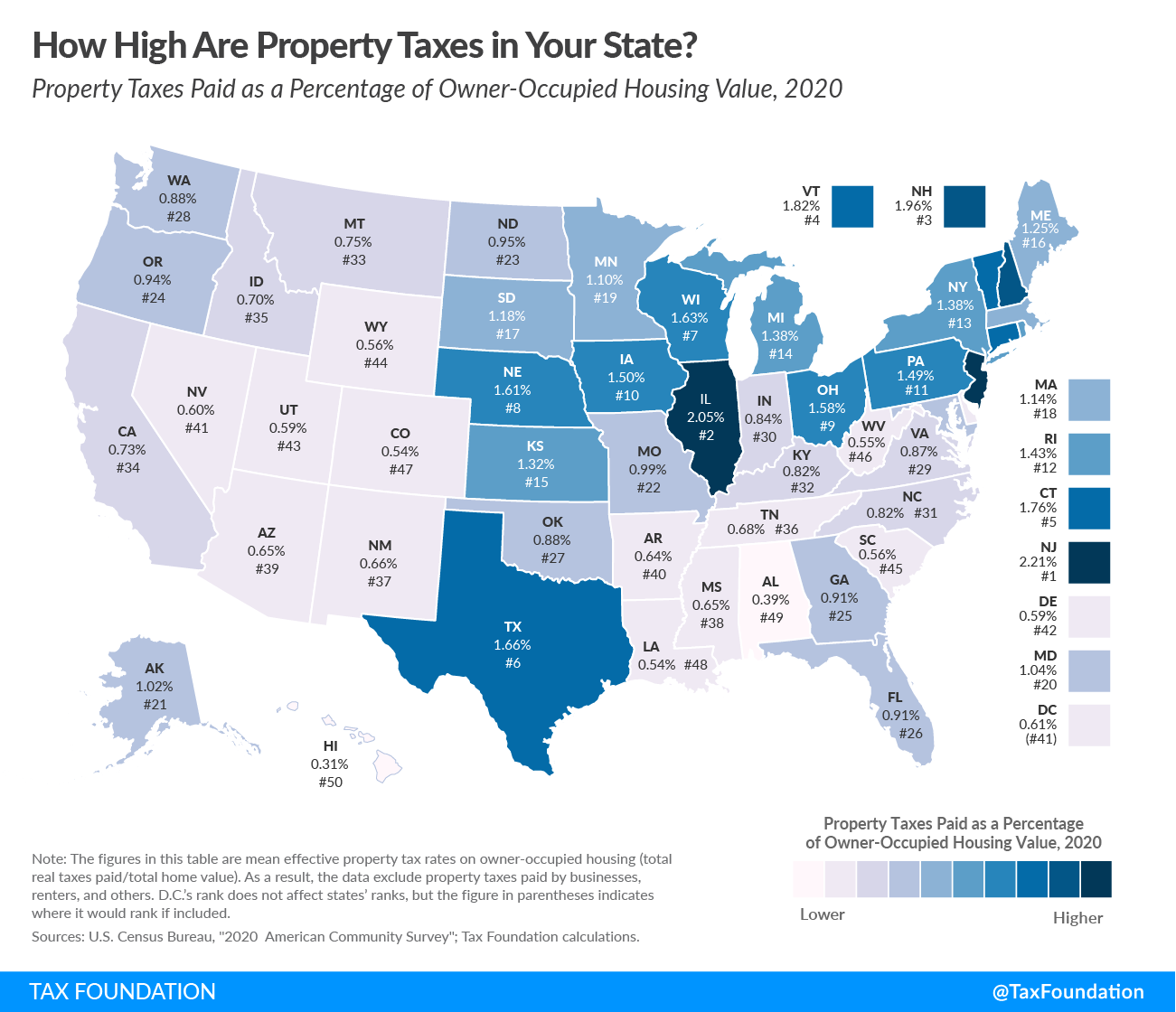

Property Taxes How Much Are They In Different States Across The Us

Uganda Revenue Authority Individual Tin Application Form Dt 1001 Pdf Thekonsulthub Com Application Form Tin Number Application

Utah Property Taxes Utah State Tax Commission

Fillable Form Personal Property Bill Of Sale Personal Property Person Bills

Property Tax By State Ranking The Lowest To Highest

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

2022 Property Taxes By State Report Propertyshark

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Sunset Sterling Heights Michigan Sterling Heights Sterling Heights Michigan Places To Visit

State Taxes On Capital Gains Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation